Best CRM for Raising Capital: A Real Estate Syndicator’s Guide

How To Pick the Best CRM for Raising Capital in Real Estate

Raising capital isn’t like running a sales team. Most CRMs like HubSpot, Salesforce, and ActiveCampaign, to name a few, were built for closing product sales, not for managing investor relationships.

If you’re a syndicator, fund manager, or real estate investor, you need a capital raising CRM that tracks soft commits, automates follow-ups, and keeps your pipeline moving toward funded deals.

Here’s how to choose the best CRM for raising capital in real estate.

If your CRM can’t answer the question, “How much is soft committed right now?” — it’s not built for capital raising.

Why Real Estate Investors Need a CRM Built for Raising Capital

Most generic CRMs simply don’t fit the unique journey of raising capital. They were designed to close product sales, not to guide investors from first touch to funded deals.

Here’s a quick look at how generic CRMs stack up against a capital raising CRM:

The Limitations of Generic CRMs

Most CRMs on the market were designed with sales teams in mind, not capital raisers. Their entire structure revolves around a short sales cycle — prospect, demo, negotiation, close. That’s not how investors operate.

👉 Example: A client of mine spent $1,800/month on HubSpot. It was great for tracking sales leads — but when it came to managing investors, they still ended up juggling spreadsheets to track who had soft committed, who had docs out, and who had funded.

Investor relationships don’t fit neatly into those boxes.

A pipeline labeled Opportunity or Closed/Won makes sense if you’re selling software, but it doesn’t capture where an investor actually stands in your raise. Are they just interested? Have they soft committed? Are docs out but not signed? A generic CRM can’t show you this, which leaves you managing investors with guesswork instead of clarity.

The same problem shows up in automations.

Generic CRMs are built to send sales follow-ups or contract reminders, not to handle the unique workflows of raising capital. You won’t find out-of-the-box support for things like webinar registrations and reminders, Deal Room access, or automated nudges for unsigned docs. That means you end up duct-taping other tools together or relying on manual follow-ups — and both create opportunities for investors to slip through the cracks.

In short, generic CRMs force you into someone else’s playbook. They weren’t built for investor trust, education, and commitments, so you spend more time wrestling with the tool than raising capital.

What a Capital Raising CRM Does Differently

A capital raising CRM starts with the reality of the investor journey. Instead of sales-centric stages, it’s built to track the flow that actually matters: Interested → Soft Commit → Docs Out → Funded. With this structure, you know exactly where every investor stands, and you can forecast your raise with confidence instead of assumptions.

Communication also changes dramatically. Instead of generic drip campaigns, you get investor-specific automations:

Webinar reminders and replay delivery.

Deal Room links sent automatically when someone requests more info.

Soft commit confirmations and doc follow-up nudges.

These aren’t “nice-to-haves” — they’re the essential touchpoints that keep investors engaged and confident throughout the process.

And because every investor is different, segmentation is built in. You can easily filter by accreditation, check size, or even investment preferences. That way, accredited investors get content highlighting bonus depreciation, while smaller check writers receive updates about reliable cash flow. The messaging always feels relevant — which builds trust and speeds up commitments.

At its core, a capital raising CRM is purpose-built to manage the two things that actually drive successful raises: relationships and commitments.

5 Features Every Capital Raising CRM Must Have

The best CRM for real estate syndicators isn’t just about features, it’s about solving the unique pain points of raising capital. Look for these five non-negotiable elements in any software you consider.

1. Investor Pipelines (Not Sales Pipelines)

A capital raising pipeline should map investor trust-building, not sales opportunities.

Example stages: New Lead → Engaged → Interested → Soft Commit → Docs Out → Funded.

2. Automated Investor Communication

Follow-up should never depend on memory. Your CRM should:

Send webinar reminders.

Deliver Deal Room access instantly.

Trigger nurture emails for passive leads.

Confirm soft commits automatically.

Automate appointment reminders

Deliver a welcome or onboarding sequence

3. Segmentation & Lists

A strong CRM for real estate syndicators lets you segment by:

Accreditation status.

Typical check size.

Investment preferences (cash flow, tax benefits, diversification).

Event history (webinar, conference, podcast).

Or any custom fields that you or are trying to track

4. Scalability Beyond Spreadsheets

Spreadsheets break once you manage more than 20–30 investors. The best CRMs handle:

Unlimited contacts.

Custom fields for investor data.

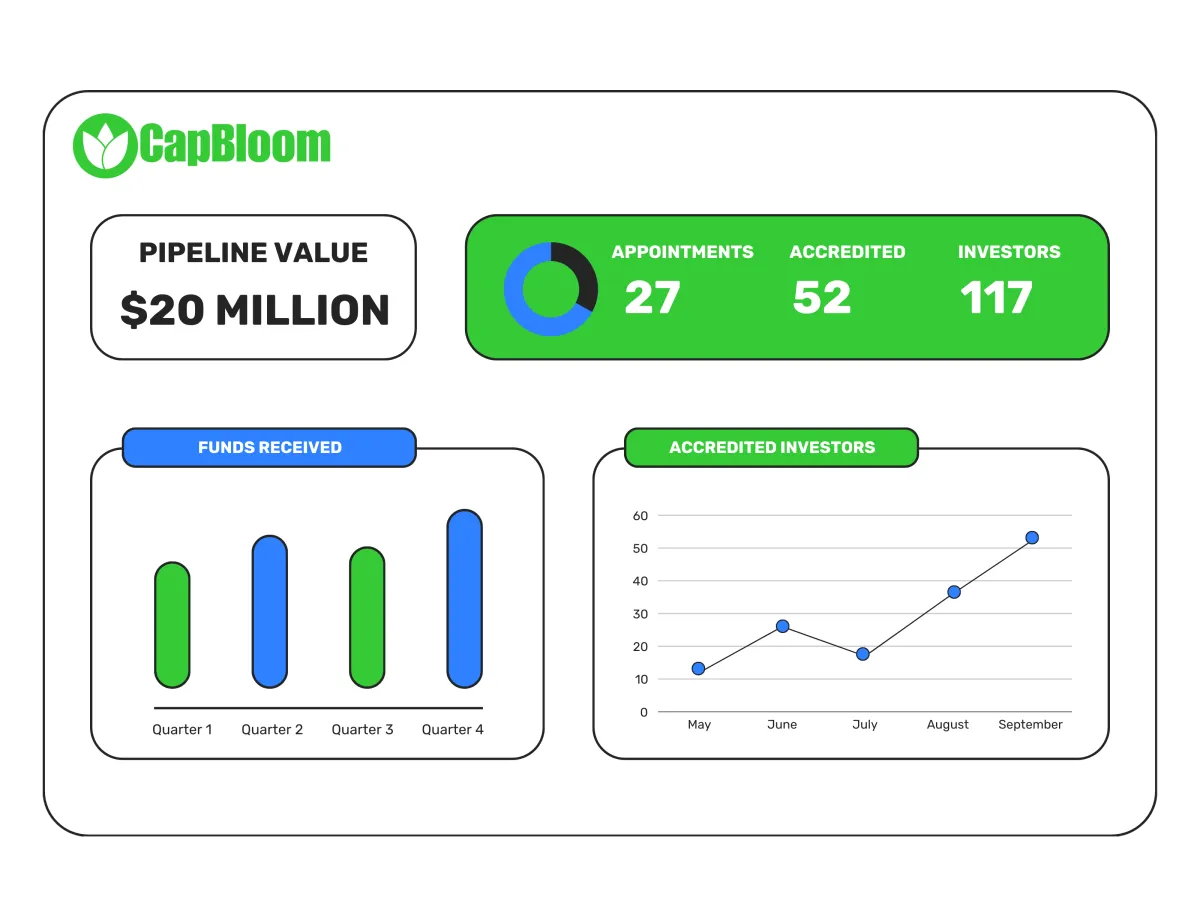

Reporting dashboards for real-time insights.

5. Education & Event Tools

Education is central to building trust. Look for real estate CRM features that support:

Hosting webinars and workshops.

Managing podcast booking and promotion.

Delivering investor courses and guides.'

Why CapBloom Is Different

CapBloom was built specifically as a capital raising CRM for real estate investors.

While most CRMs force you to adapt generic sales processes for a unique industry, CapBloom was built from the ground up to serve one purpose: helping real estate investors raise capital.

This specialization means you don’t have to waste time building custom pipelines or workflows. Instead, CapBloom provides a fully functional system straight out of the box, including pre-built investor pipelines that reflect the specific stages of a deal. It also comes equipped with automated workflows for real estate such as webinars, deal launches, and soft commits. By including a high deliverability email setup and purpose-built tools for managing conferences, meetups, and educational events, CapBloom helps you build investor trust and keep your capital pipeline moving without the friction of a mismatched system.

Choosing the Best CRM for Raising Capital in Real Estate

If you’re evaluating the best CRM for raising capital in real estate, make sure it fits the way investors actually make decisions — with trust, education, and consistent follow-up.

Book a Demo of CapBloom to see how it helps syndicators, fund managers, and real estate investors raise more capital with less friction.